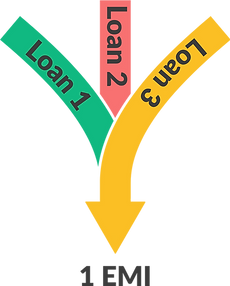

What is Debt Consolidation?

Debt consolidation is the process of combining multiple loans or credit card dues into a single loan with one EMI. It simplifies repayment and may reduce your overall interest burden.

In India, debt consolidation is usually done through personal loans, credit card balance transfers, top-up loans, or loans against property. It’s ideal for those handling several EMIs or high-interest debts, especially when missing due dates becomes frequent.

The main benefit of debt consolidation is ease—just one EMI to track. It may also lower interest rates, reduce monthly payments, and improve your credit score if repayments are made on time.

To apply, you’ll need basic documents like PAN, Aadhaar, income proof, and details of the debts to be consolidated. Compare offers from banks, NBFCs, or fintech lenders, and check terms like processing fees and foreclosure charges.

Before opting in, ensure the new loan genuinely reduces your financial burden. Avoid borrowing more than needed and continue timely payments post-consolidation.

Done right, debt consolidation helps you regain control over your finances and build a better credit future.

Why should I Consolidate my Debts?

Reduced

Rates

Longer

Tenure

Improved

Credit Score

Top-Up

Loan

Which Documents do I need to Consolidate my Debts?

Identity Proof

Any one of the following

-

PAN Card or Form 60 (Mandatory)

-

Aadhar Card

-

Driving License

-

Voters ID

-

Passport

-

Photo

Address Proof

Any one of the following

-

Rent/Lease Agreement

-

Utility Bill

-

Aadhar Card

-

Driving License

-

Ration Card

Income Proof

Mandatory Documents

-

Application Form

-

Photograph

-

Bank Statements

-

Repayment Schedule of Existing Loan/s

-

Audited ITR

Frequently Asked Questions

Who should consider debt consolidation?

It’s ideal for people juggling multiple EMIs, especially those with high-interest credit card dues or personal loans. It reduces financial stress and the risk of missed payments.

Can I consolidate credit card debt?

Absolutely. Many people use personal loans to clear high-interest credit card dues, replacing 36–42% annual rates with a 12–18% personal loan.

Are there risks in debt consolidation?

If not planned well, you may fall back into the debt trap by taking new loans on top of the consolidated one. Also, prepayment penalties on old loans might apply.

What documents are required for a debt consolidation loan?

Same as a personal loan:

> PAN & Aadhaar

> Salary slips/ITR

> Bank statements

> Loan statements for existing debts

How is a balance transfer different from debt consolidation?

A balance transfer usually refers to moving one loan to a new lender for a better rate. Debt consolidation combines multiple loans into one.